Receipt and Payment Account for Not for Profit Organisation

If you bring forward the ending balance, then the subscription account will now looks like this. (I showed this because I think most people will get confused on which entry should you put owing b/d or prepaid b/d). The best way to learn is through repetition so make sure to review your notes on the Receipt and Payment Account often.

Key Difference Between Receipt And Payment Account and Income And Expenditure Account

Donna is a classroom practitioner with over 25 years experience in teaching accounting and business studies at GCSE A-Levels and undergraduate levels, both in the UK and abroad. She currently works for a Multi-Academy Trust (MAT) as a teacher, instructional coach and mentor to other teachers. Donna is also an AQA A Level Accounting examiner as well as the content creator of resources used by all accounting teachers across the Trust. She enjoys designing and creating resources that provides students with deeper understanding of the subject content. Donna has a Bachelor of Science Degree in Business Administration with major in Accounting and Finance (BSc Hons) and ACCA certified to Level 2.

- Balance of cash in hand and cash at the bank are taken from the cash book and recorded first on the debit side under the receipts column.

- It does not differentiate between the receipts and payments, whether they are of capital or revenue in nature and records all cash and bank transactions of both capital and revenue nature.

- The difference between the two sides represents the cash balance at the end of the period.

- Yes, freelancers and small business owners can benefit greatly from this payment term to ensure consistent cash flow and avoid chasing clients for payments.

- These areas will be discussed thoroughly at university so it’s best to get ahead now by reading up on the topic or talking with someone who has experience dealing with these matters .

Receipts and Payments Accounts

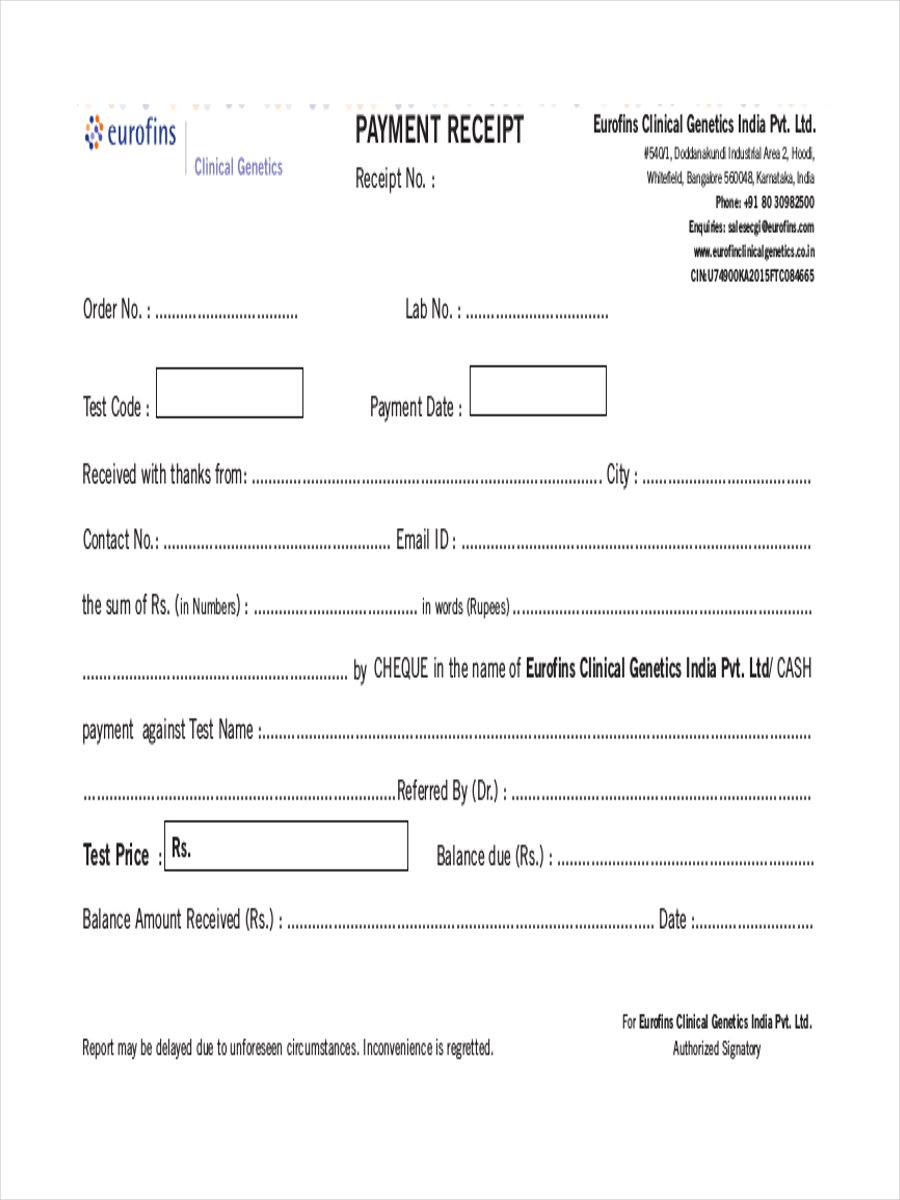

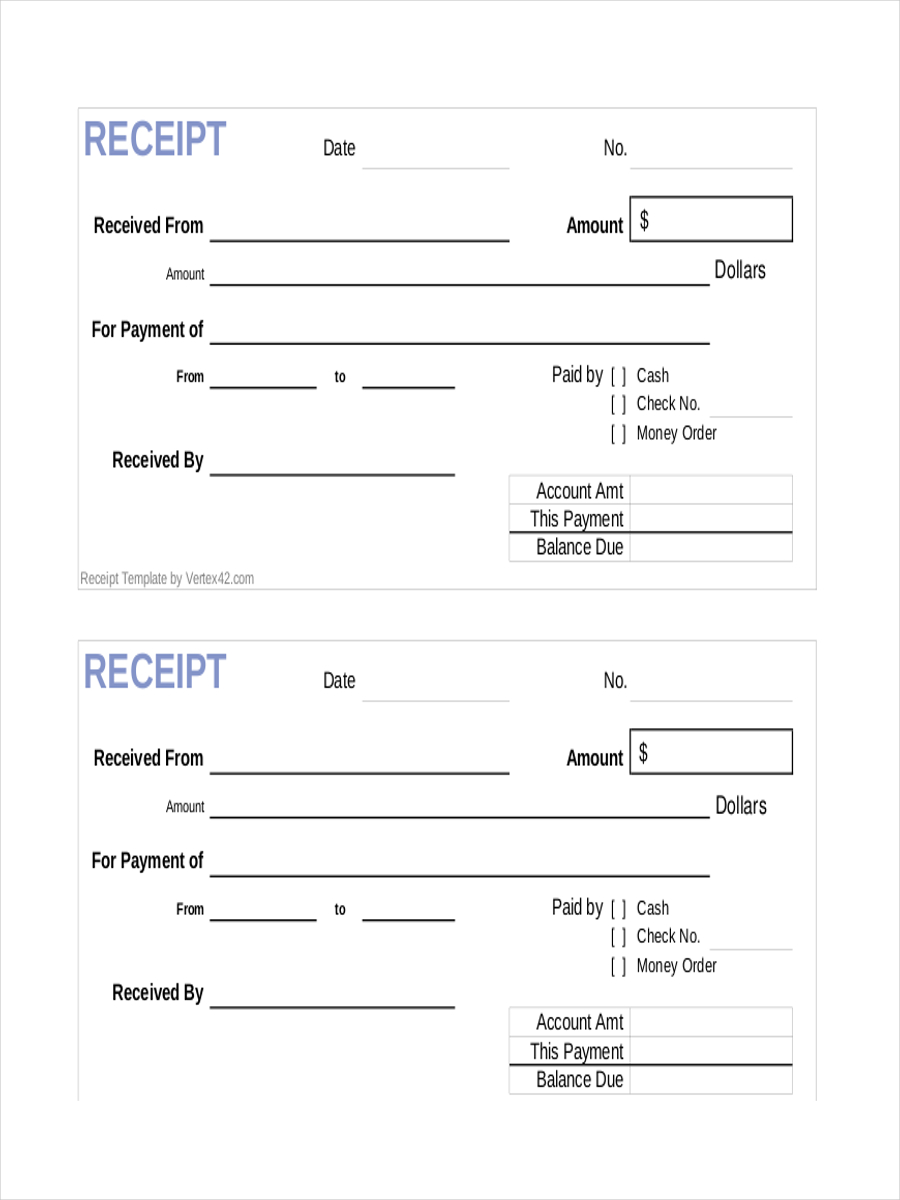

Now that you have a receipts and payments format, here is a solved example for students of commerce. This account is prepared by getting all the invoices and payment details from the business cash book for the year. Make sure you review your notes about the full time equivalent fte definition, how to calculate, importances frequently. This will make it simpler to remember the information and more useful.

What is the approximate value of your cash savings and other investments?

The difference between Receipt and Payment Account and Income and Expenditure Account lies in their specific functions and the information they offer. These two financial statements are used to monitor and report the financial transactions of an entity, yet their uses and benefits are unique. With faster payments, businesses can maintain a stable cash flow, enabling them to reinvest in operations or cover expenses without delay. This is particularly useful for businesses with tight operating margins.

All receipts are grouped under headings such as entrance fees, annual subscriptions, lifetime subscriptions, donations, interest, and sundry receipts. Closing balance of Cash in Hand for the year 31st March,2021 was ₹7,000. ‘Due Upon Receipt’ means payment is expected immediately after the invoice is received, while ‘Net 30’ gives the customer 30 days to make the payment. Payment terms are traditionally more extended in specific industries, such as manufacturing or large-scale B2B transactions, making ‘Due Upon Receipt’ less common and possibly unappealing to clients. Immediate payment upon receipt minimizes the risk of clients forgetting to pay or defaulting on payments.

Preparation and Filing of Accounts

You must record these transactions to manage them in the future easily. You should ensure that there are no large discrepancies in receipts or payments. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

As such, the income and expenditure account is part of the double entry system, while the receipts and payments account is not. An income and expenditure account is a financial statement that summarizes a company or organization’s revenues and expenses over a certain period of time, typically a fiscal year. It is often used to assess the financial performance of the company and to compare it to previous years or to industry averages. The statement usually includes details of all income received and all expenses incurred, including the cost of goods sold, operating expenses, and taxes.

The account starts with an opening balance “To balance b/d” and all the transactions are recorded according to the specified rules. The account ends with “By balance c/d” after the totalling is done. As for the other side, the credit side records all the payments done, i.e outflow of cash. For example, A machinery was bought for Rs. 5000 and is recorded as “By Machinery- Rs. 5000” on the credit side because of the outflow of cash towards machine purchase. Similarly, purchases and salary are made and recorded respectively as “By purchase Rs. 5000, By salary Rs. 10000” because of the outflow of cash. Suppose there is a subscription plan by the business and any cash coming in because of that subscription is recorded in the receipts tab as shown “To subscription – Rs. 5000”.